At Metalcolor, we are continuously improving our tools to meet our customers’ needs. After several years of preparation and work, the modernization of our L1 coating line is complete.

The goal: to meet the growing demand for multilayer, durable, and diverse products while ensuring our flexibility.

Thanks to the addition of a new coating section and a state-of-the-art curing oven, we can now apply multiple lacquer layers in a single session.

More possibilities, more control

The new section includes four coaters and a high-energy-efficiency oven. It enables us to produce innovative multilayer systems with higher quality — even for complex shades or technical finishes.

Intelligent systems for monitoring production parameters ensure reliability and reproducibility while optimizing our energy consumption. The new oven maximizes energy recovery and reuses hot process air, further reducing our natural gas consumption and CO₂ emissions.

A technical project, a human challenge

To avoid extended production downtime, a major part of the work was carried out during scheduled stoppages, with special precautions taken to protect sensitive equipment against dust and vibrations.

Despite the challenges of the Covid-19 context, our team adapted and successfully completed this project.

A step towards the future

With this modernization, Metalcolor offers more technical solutions tailored to today’s and tomorrow’s expectations.

This project reflects our strategy: combining innovation, quality, and environmental responsibility to produce more efficiently and sustainably.

Helder Cerqueira

Head of Production

Since its founding in 1981, Metalcolor has been adapting its expertise to meet the technical and aesthetic needs of the coil coating market. Today, we take another step forward with the release of our first Environmental Product Declaration (EPD), validated by the independent MRPI platform in the Netherlands, in accordance with EN 15804+A2 and ISO 14025 standards.

This declaration is based on a complete Life Cycle Assessment (LCA) of our pre-coated aluminium strips, from raw material extraction to the factory gate. It provides our customers and partners with clear, comparable data on the environmental footprint of our products.

A concrete environmental commitment

Since 2008, Metalcolor has been committed—through an agreement with the Swiss authorities—to improving its energy efficiency and reducing its greenhouse gas emissions. This commitment resulted into numerous concrete actions:

- Exclusive use of renewable electricity produced in Switzerland,

- Installation of 5,700 m² of photovoltaic panels on the roof of our Forel/Lavaux plant, in partnership with Holdigaz SA and Energiapro SA,

- Commissioning of a regenerative thermal oxidizer, reducing natural gas consumption by 33% through heat recovery,

- Use of nearly 80% recycled aluminium in our production,

- Optimized recovery of excess paint thanks to a dedicated software,

- Launch of a decarbonization roadmap to gradually eliminate fossil fuels from our processes.

These efforts are part of a structured approach, supported by our double certification: ISO 14001 (environmental management) and ISO 50001 (energy management).

A commitment we share

Increasingly, construction projects, eco-design initiatives, and public tenders require reliable environmental data. The EPD addresses this need by providing standardized and transparent information.

Metalcolor’s EPD is available upon request. Contact us anytime if you would like to know more.

Morgane Bourdon

ISO & IMS Coordinator

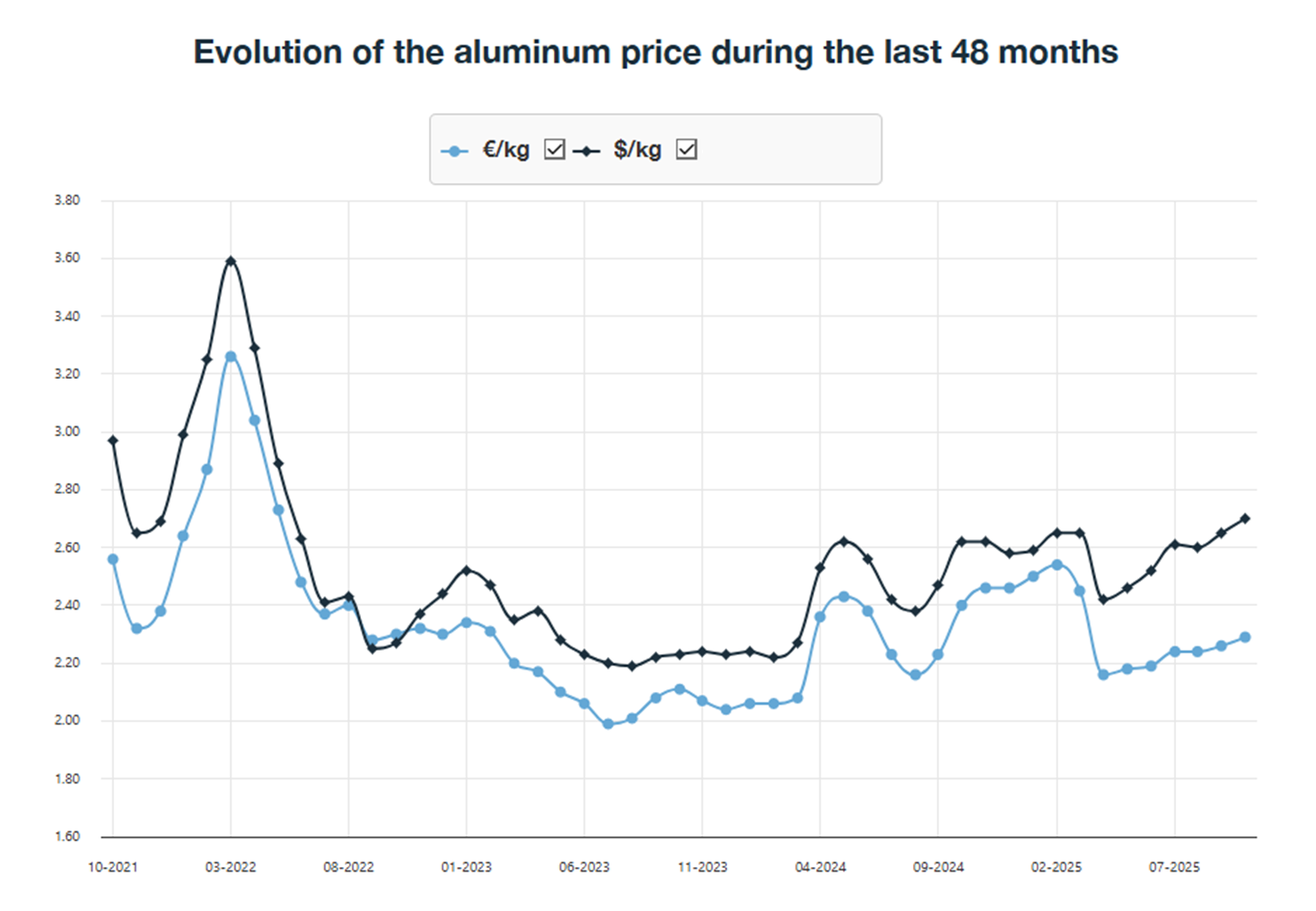

The global aluminium market is going through a transitional phase, marked by hesitant demand, persistent geopolitical tensions, and major tariff adjustments. After a notable increase in LME prices during spring, the summer months proved more volatile, and the outlook for autumn remains cautious.

Following a decline between late March and mid-April, the 3-month LME price rebounded by more than 15%, reaching $2,664/t in July before stabilizing around $2,560/t in August — a level comparable to early 2025. This rise reflects the broader context of global trade tensions, influenced by the US dollar and tariff announcements. Europe remains relatively shielded thanks to a favourable €/USD exchange rate.

In the United States, scrap prices declined across most grades, particularly those linked to extrusion and the automotive sector. Domestic demand remains weak, although a recovery is expected in the second half of the year.

In Europe, scrap prices remained stable at high levels. The European Commission is considering possible restrictions on scrap exports, adding another layer of regulatory uncertainty.

In summary, the aluminium market is characterized by abundant supply, hesitant demand, and political uncertainties. Market players will need to act with caution and agility to navigate this complex environment in the coming months.

Luis Ovelha

Head of Sales & Marketing

After two years of decline, including a particularly difficult 2024 (–2.1%), the construction sector in Europe (EC-19 zone) is beginning a gradual recovery:

EUROCONSTRUCT forecasts predict:

- +0.3% in 2025 (Euroconstruct Summary Report, p.42)

- +2.0% in 2026 (Euroconstruct Summary Report, p.42)

This trend is driven by lower interest rates, an improving macroeconomic outlook, and supportive public policies.

Sector Developments (according to EUROCONSTRUCT)

Residential (~48% of the construction market):

- Still in decline in 2025 (–1.1%), but recovery expected in 2026 (+1.8%) followed by an acceleration in 2027 (+2.8%).

- This sector is expected to be the main driver of the turnaround from 2026 onward, supported by central banks’ interest rate cuts.

- New construction: +0.3% in 2025

- Renovation: –2.0% in 2025

Non-residential (~30.2% of the construction market):

- Moderate growth (+1.8% per year), driven by renovation and new environmental standards.

- Outlook weighed down by fragile public finances, weak domestic demand, and budget cuts in several countries (e.g., Austria and Italy).

Civil Engineering (~21.5% of the construction market):

- The most dynamic segment: +2.5% in 2025 and +2.4% in 2026

| Strongest performers in 2026 (real growth) | Struggling in 2026 (real growth) |

|---|---|

| Poland: +8.7% (+8% in 2025) | Belgium: -3.2% (+1.5% in 2025) |

| Eastern Europe: +6% (+4.6% in 2025) | Finland : -1.7% (+4.8% in 2025) |

| Switzerland: +4.3% (+3.9% in 2025) | Austria: -0.9% (+1.1% in 2025) |

Strong National Contrasts

- Poland: Growth leader with +16.5% across the entire construction market, supported by strong economic recovery, significant public investments financed by EU funds, and a large-scale thermal renovation program (788,000 housing units).

- Germany: Stagnant market (–2.1% in 2025, +0.3% in 2026), weighed down by soaring production costs, energy requirements, subsidy cuts, rent regulation, a discouraging tax regime, falling purchasing power, and labour shortages.

Luis Ovelha

Head of Sales & Marketing

Source: EUROCONSTRUCT https://www.euroconstruct.org/reports