Aluminium Market: LME Status and Scrap Dynamics

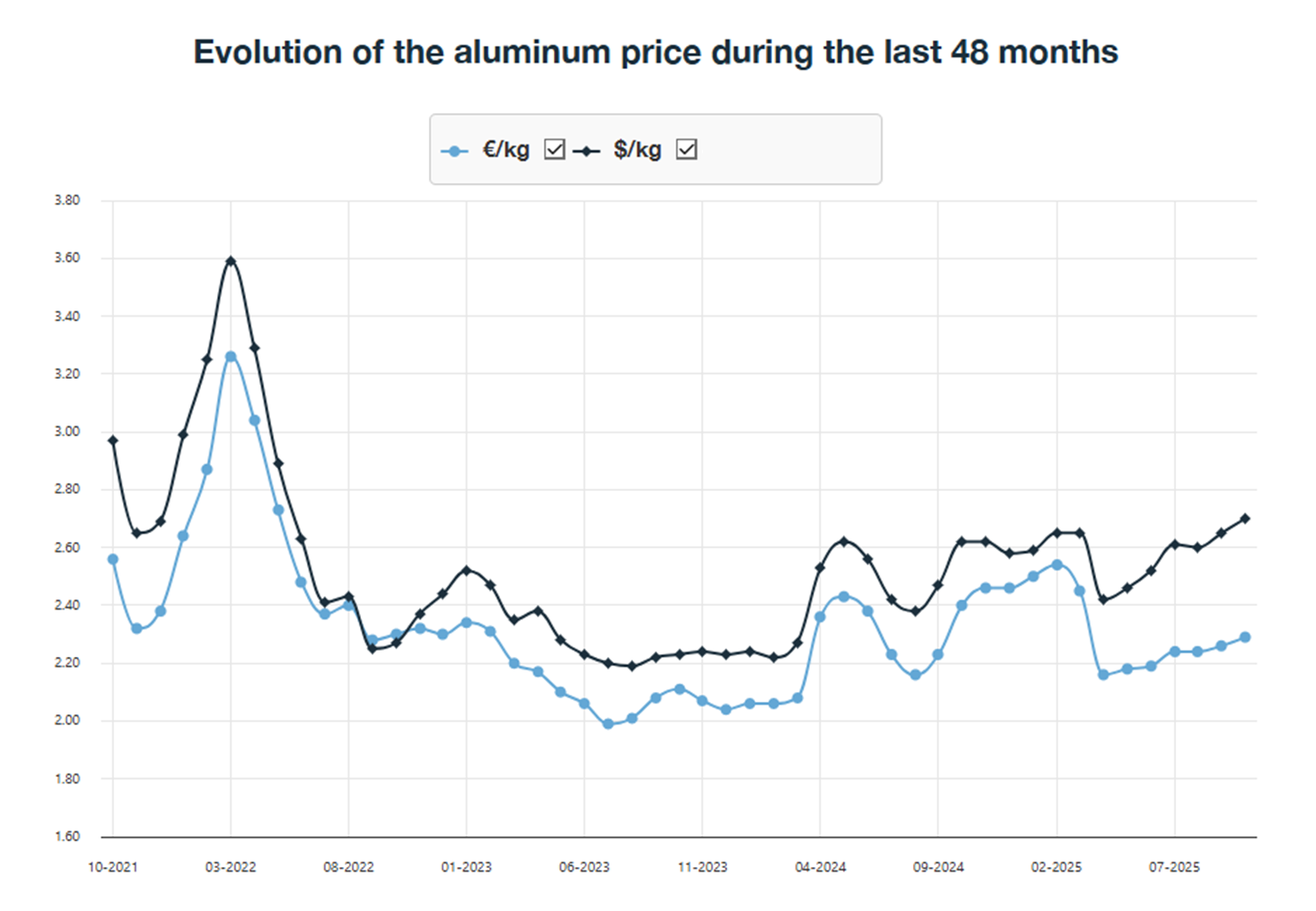

The global aluminium market is going through a transitional phase, marked by hesitant demand, persistent geopolitical tensions, and major tariff adjustments. After a notable increase in LME prices during spring, the summer months proved more volatile, and the outlook for autumn remains cautious.

Following a decline between late March and mid-April, the 3-month LME price rebounded by more than 15%, reaching $2,664/t in July before stabilizing around $2,560/t in August — a level comparable to early 2025. This rise reflects the broader context of global trade tensions, influenced by the US dollar and tariff announcements. Europe remains relatively shielded thanks to a favourable €/USD exchange rate.

In the United States, scrap prices declined across most grades, particularly those linked to extrusion and the automotive sector. Domestic demand remains weak, although a recovery is expected in the second half of the year.

In Europe, scrap prices remained stable at high levels. The European Commission is considering possible restrictions on scrap exports, adding another layer of regulatory uncertainty.

In summary, the aluminium market is characterized by abundant supply, hesitant demand, and political uncertainties. Market players will need to act with caution and agility to navigate this complex environment in the coming months.

Luis Ovelha

Head of Sales & Marketing